Packing for Japan was easy. Passport, money, clothes, toiletries and two open stock positions. Thinking it was a manageable number of trades to leave open, all I needed was access to prices and basic charts on my phone.

My trading plan tells me to close all trading positions before a holiday or bring a laptop and be prepared to monitor them. Checking in on each stock wasn’t going to take much time but I didn’t bring the laptop. Mistake number one.

Trading Positions

Two trading stocks were still open in the portfolio.

Trade 1 - CYL CATALYST METALS LIMITED

CYL had a strong trending chart. Investors were in full support as indicated by the widely spaced exponential moving averages, providing a solid foundation for high probability recoveries on any price pullbacks.

Open Position

🛑 Stop Loss at ATR 1.98

❇️ Entry at 2.18

🎯 Target Profit 2.61

Tracking the Trade

Price rose after the entry as marked by the purple arrow.

🎯✅ Target Profit Achieved

After a short time of sideways consolidation, CYL achieved the target profit set for a 20% profit return.

The uptrend for CYL appeared strong so the trade was left open.

✈️ Holiday Mode ON

Bad timing saw the price of CYL drop sharply the day after I left for my holiday.

Walking 20K steps a day and always on the go from morning until night was exciting, exhausting and not an ideal state of mind for remembering to check trades properly.

Closing Position

One of the limiting factors for not checking properly was leaving the laptop behind. The mobile did not display the usual trailing ATR stop loss indicator. Changing to an alternative stop loss signal for this trip, that of a certain percentage drop in profit, was harder to track.

CYL was closed after I returned from holidays at $2.64, marked by the orange star on the chart. Only a little over the original profit target.

Post Trade Analysis

These were the alternative actions for managing the CYL trade:

1. Close trade before holiday

Sell at $3.50 for a profit return of 60%

2. Close trade during holiday

Sell at $3.00 for a profit return of 38%

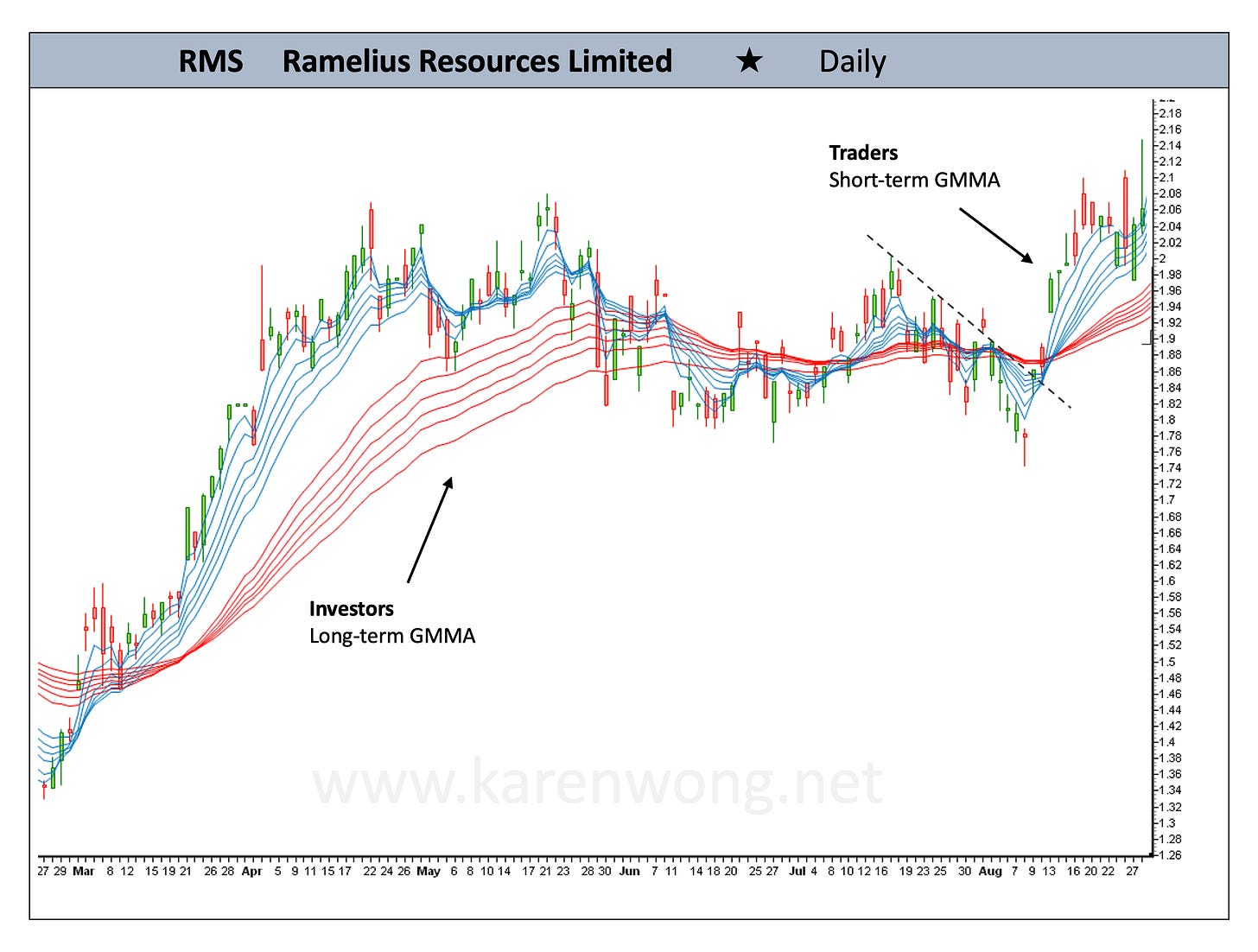

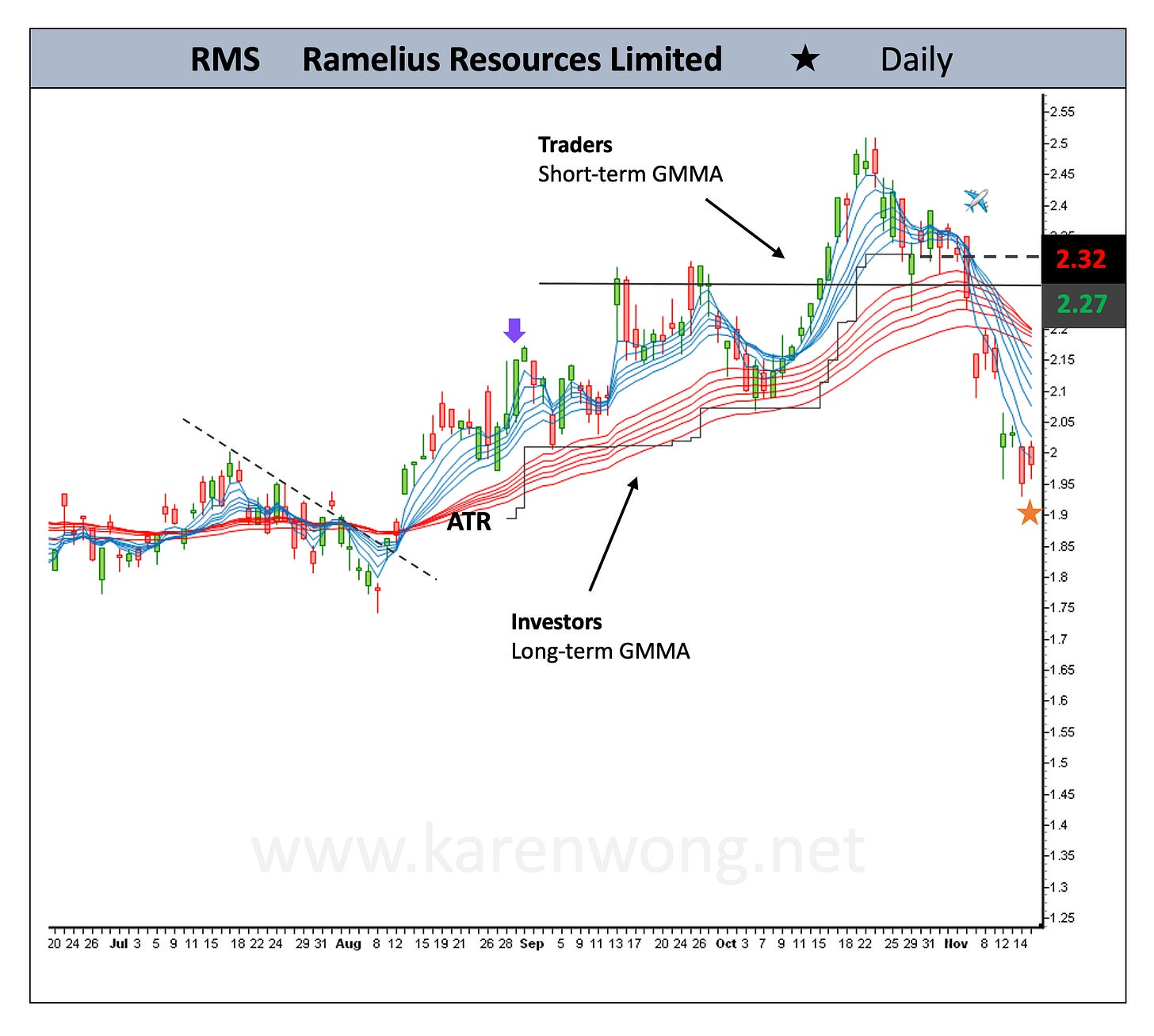

Trade 2 - RMS RAMELIUS RESOURCES LIMITED

A new uptrend leg had broken out and was well supported by both traders and investors. The gap between the short and long-term GMMA groups signalled good buying strength in the trend.

Open Position

🛑 Stop Loss at ATR 2.08

❇️ Entry at 2.18

🎯 Target Profit 2.40

🎯✅ Profit Target Achieved

The ATR trailing profit stop was compatible with the price dips on the chart allowing the trade to remain open. Profit target of $2.40 was achieved and the trade was left open to allow profits to run some more, past the guaranteed profit of 10%.

✈️ Holiday Mode ON

Price dropped the day after my holiday started. Failing to check on price and close the trade while on holiday saw price continually drop past the stop loss of $2.32.

Closing Position

RMS was closed after I returned from holidays at $1.97, marked by the orange star on the chart. Closed at a loss of 10%.

Post Trade Analysis

These were the alternative actions for managing the RMS trade:

Close trade before holiday

1. Sell at $2.36 for a profit return of 8%

Price activity was close to triggering the ATR stop line for a few days before departure with the potential of price to drop and close beneath at any time. Another warning signal was the compression of the exponential moving average lines of the short-term group. Traders were losing interest.

Close trade during holiday

2. Sell at $2.15 for a loss of 1.4%

Making the Decision to Close or Monitor

Based on previous experience, if a holiday is a familiar regular routine one, monitoring is easier. For a more active holiday, it becomes a lot harder to focus.

Closing positions may be the better option for a complete break away from the markets. Locking in the profit or limiting a loss.

Better Monitoring of Open Positions

One or more of the following ideas may be helpful

1. Take partial profits before heading off

2. Pack in the laptop

3. Full chart access to indicators for proper analysis

4. Set price alerts signalling weakness in the share price

5. Set automatic or conditional stop losses on the trading platform

6. Know the exact stop loss price for exiting

In hindsight, closing both of these trades before the start of the holiday was the better strategy. A guaranteed profit in the bank and a mind free from baggage. Close positions or leave positions open. We can’t always get it right so we prepare to accept the consequences of our choices.

hello Karen another great read you are really good explaing the stocks thanks Maurie